Nickel foil is a critical material widely used in electronics, aerospace, energy storage, and chemical industries. The price of nickel foil is influenced by several global and sector-specific factors, ranging from raw material costs and supply chain disruptions to technological innovations and geopolitical developments. Understanding the dynamics behind nickel foil pricing is crucial for manufacturers, suppliers, and investors who rely on this versatile material.

What Is Nickel Foil?

Nickel foil is a thin sheet of nickel metal, usually with thicknesses ranging from a few micrometers to several hundred micrometers. It offers excellent corrosion resistance, thermal stability, and electrical conductivity. These properties make it essential in applications such as battery electrodes, shielding in electronic components, and chemical process equipment.

Current Nickel Foil Price Overview (As of June 2025)

| Region | Nickel Foil Price (USD/kg) | Change (MoM) |

|---|---|---|

| North America | 76.20 | +3.2% |

| Europe | 78.10 | +2.5% |

| China | 74.90 | +3.8% |

| India | 73.30 | +2.1% |

Historical Price Trend of Nickel Foil (2020–2025)

| Year | Average Price (USD/kg) | Yearly Change |

|---|---|---|

| 2020 | 52.40 | — |

| 2021 | 59.80 | +14.1% |

| 2022 | 67.20 | +12.3% |

| 2023 | 71.50 | +6.4% |

| 2024 | 73.90 | +3.4% |

| 2025 (YTD) | 76.10 | +3.0% |

Factors Influencing Nickel Foil Prices

1. Raw Nickel Price: Since nickel foil is derived from pure nickel, the price of raw nickel is a major influence. A spike in LME nickel prices leads to direct increases in foil costs.

2. Processing Costs: Nickel foil requires precision rolling, annealing, and surface treatments. Energy, labor, and technology used in these steps affect final pricing.

3. Global Demand: The surge in demand for lithium-ion batteries, electric vehicles (EVs), and fuel cells directly boosts nickel foil consumption and pricing.

4. Supply Chain Dynamics: Disruptions in mining, logistics, or political instability in nickel-producing countries can constrain supply and drive up prices.

5. Currency Fluctuations: As nickel is traded globally in USD, exchange rate movements impact import/export costs and local prices.

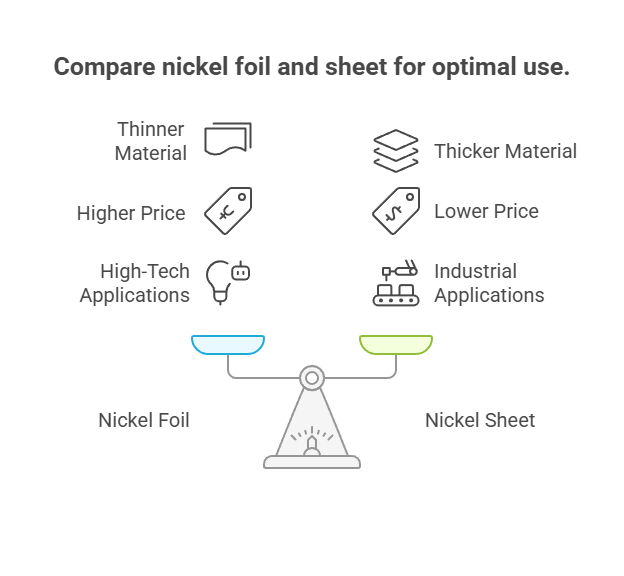

Nickel Foil vs. Nickel Sheet: Price and Use Case Comparison

| Feature | Nickel Foil | Nickel Sheet |

|---|---|---|

| Typical Thickness | < 0.1 mm | ≥ 0.1 mm |

| Average Price (USD/kg) | 76.10 | 45.30 |

| Primary Applications | Electronics, batteries, chemical catalysts | Industrial parts, structural components |

Major Global Suppliers of Nickel Foil

| Company | Country | Product Range |

|---|---|---|

| JX Nippon Mining & Metals | Japan | High-purity nickel foil for EV batteries |

| Hitachi Metals | Japan | Precision rolled nickel products |

| Umicore | Belgium | Nickel-based thin foils and coatings |

| Furukawa Electric | Japan | Nickel foil for electronics |

Future Outlook for Nickel Foil Prices

Given the increasing use of nickel foil in green energy applications, particularly in EV battery technologies and hydrogen fuel cells, the market demand is expected to grow steadily. While supply chain improvements may stabilize prices in the long term, short-term price volatility will likely persist due to market speculation, regional conflicts, and demand surges.

Frequently Asked Questions

What is the current price of nickel foil per kg?

The global average price of nickel foil in June 2025 is approximately USD 76.10 per kilogram, with regional variations from USD 73.30 to USD 78.10 depending on market conditions.

Why is nickel foil more expensive than nickel sheet?

Nickel foil is more expensive due to its complex manufacturing process, which involves multiple precision steps like rolling, heat treatment, and cleaning. Additionally, it caters to high-tech applications where quality and consistency are critical.

Who are the leading suppliers of nickel foil?

Major global suppliers of nickel foil include JX Nippon Mining & Metals (Japan), Hitachi Metals (Japan), Umicore (Belgium), and Furukawa Electric (Japan), all known for producing high-purity and specialized nickel materials.