Pure nickel is a critical industrial metal used in batteries, aerospace, electronics, and chemical industries. Its price is influenced by global demand, mining output, energy markets, and geopolitical shifts. In 2025, pure nickel prices have remained volatile due to the growing electric vehicle (EV) market and increasing demand for high-purity nickel in battery production. This article breaks down the current prices, historical trends, grade differences, and major price drivers for pure nickel in various forms.

Current Pure Nickel Prices (June 2025)

The price of pure nickel depends on form (bar, strip, wire, sheet), grade (Nickel 200, 201), and market region. Below is a breakdown of current average prices in USD per kilogram:

| Nickel Form | Grade | Purity | Average Price (USD/kg) |

|---|---|---|---|

| Nickel Bar | Nickel 200 | ≥99.6% | $38 – $52 |

| Nickel Wire | Nickel 200/201 | ≥99.6% | $32 – $47 |

| Nickel Strip | Nickel 200 | ≥99.6% | $30 – $46 |

| Nickel Sheet/Plate | Nickel 201 | ≥99.6% | $29 – $45 |

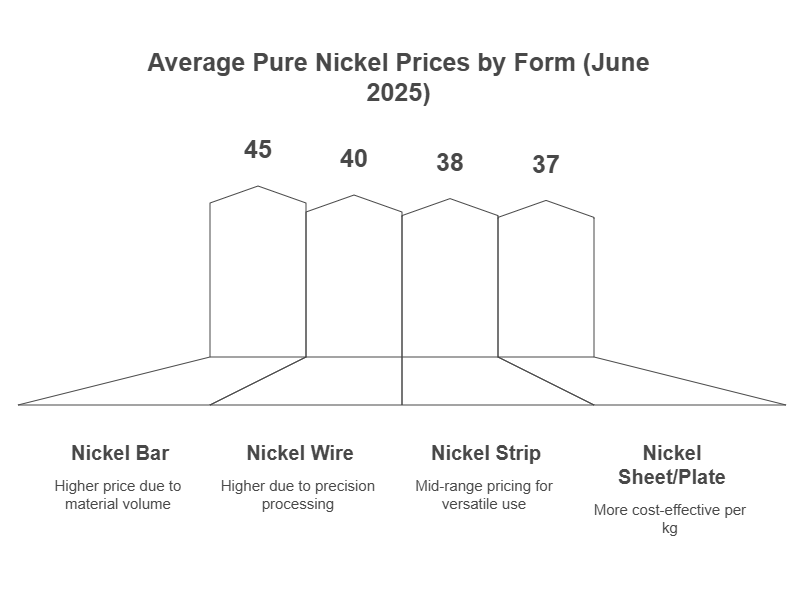

Nickel Price vs. Form: Why Shape Affects Cost

The physical form of nickel impacts its price due to processing and manufacturing costs. Here’s how prices vary across different forms even for the same grade:

| Form | Processing Difficulty | Unit Price Impact |

|---|---|---|

| Bar | Moderate (extrusion/rolling) | Higher price due to material volume |

| Wire | High (drawing, annealing) | Higher due to precision |

| Strip | Medium | Mid-range pricing |

| Sheet | Low–Medium | More cost-effective per kg |

Global Market Prices by Region

Pure nickel pricing also changes depending on the buying location. This reflects shipping, tariffs, local demand, and logistics costs.

| Region | Price Range (USD/kg) | Notes |

|---|---|---|

| China | $30 – $45 | Largest volume of nickel supply, highly competitive pricing |

| USA | $35 – $50 | Reliable domestic sources, fast delivery, higher labor costs |

| Europe | $38 – $55 | Higher environmental standards, less volume production |

| India | $32 – $46 | Improving manufacturing capacity, competitive exporters |

Historical Pure Nickel Price Trend (2023–2025)

Nickel prices have fluctuated due to demand from the EV battery sector and shifting geopolitical situations. Here is a snapshot of average Nickel 200 prices over the last 3 years:

| Year | Average Price (USD/kg) | Key Events |

|---|---|---|

| 2023 | $36.50 | Global recovery from pandemic, rising EV demand |

| 2024 | $39.10 | Indonesian export limitations, LME supply tightening |

| 2025 (YTD) | $42.30 | Battery sector boom, increased clean energy investments |

Factors That Influence Pure Nickel Pricing

Pure nickel is a commodity metal, and its price is governed by a range of economic and technical factors:

| Factor | Impact on Price |

|---|---|

| LME Nickel Futures | Sets the base global price |

| Battery Industry Demand | High-purity nickel is vital for lithium-ion batteries |

| Mining Output | Supply shortages cause sharp price increases |

| Energy and Labor Costs | Affect processing and refining expenses |

| Geopolitical Stability | Regions like Indonesia and Russia influence global supply |

Grade Comparison: Nickel 200 vs. Commercial Nickel

There are several nickel grades, but the most commonly traded for high-purity uses is Nickel 200. Here’s how it compares to lower-grade commercial options:

| Property | Nickel 200 | Commercial Nickel |

|---|---|---|

| Purity | ≥99.6% | ≥99.0% |

| Electrical Conductivity | High | Moderate |

| Corrosion Resistance | Excellent | Good |

| Price | $38 – $52/kg | $30 – $42/kg |

How to Buy Pure Nickel at the Best Price

1. Compare Multiple Quotes: Request pricing from at least 3 suppliers across regions.

2. Choose the Right Form: Select a form that minimizes waste for your application.

3. Watch the LME Market: Nickel prices are tied to London Metal Exchange futures—monitor before buying.

4. Use Spot vs. Contract: For long-term needs, consider locking prices via contract to avoid volatility.

5. Check for Certification: Always verify purity (99.6%+) and request mill test certificates (MTCs).

Related Questions

What is the current price of pure nickel per kg?

As of June 2025, the average price of pure nickel (Nickel 200/201) ranges from $38 to $52 per kilogram depending on form and region.

Why is pure nickel expensive?

Pure nickel is expensive due to limited mining supply, energy-intensive refining, and growing demand from battery and aerospace sectors.

What affects pure nickel pricing the most?

The biggest influences on pure nickel pricing are LME futures, EV battery demand, mining output from countries like Indonesia, and global shipping/logistics costs.