Nickel‑titanium alloy wires, commonly known as Nitinol, are prized for their unique shape‑memory and superelastic properties. Widely used in medical, aerospace, orthodontic, and industrial applications, Nitinol wire prices fluctuate based on alloy grade, diameter, quantity, and supplier location. This comprehensive guide covers current pricing, key cost drivers, purchase tips, and answers common buyer questions.

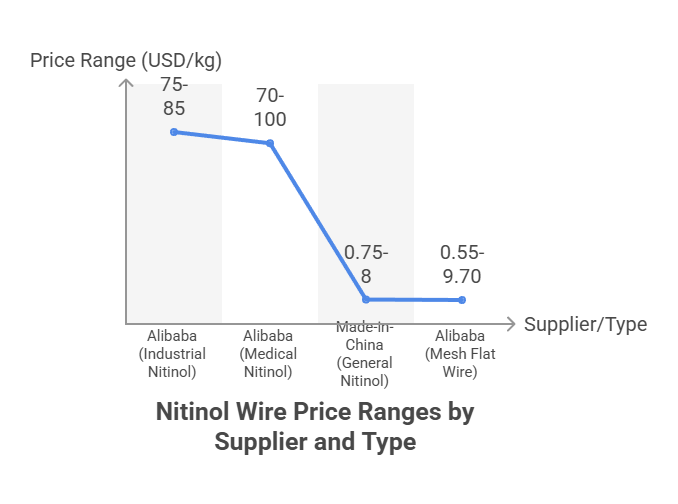

Current Price Ranges (USD per kg, Mid‑2025)

| Source / Supplier | Wire Type | Diameter | Price Range (USD/kg) |

|---|---|---|---|

| Alibaba (industrial Nitinol) | Various | — | 75–85 USD/kg (MOQ ≥5 kg) :contentReference[oaicite:0]{index=0} |

| Alibaba (shape‑memory medical wire) | Nitinol guide wire | 0.1 mm | 70–100 USD/kg :contentReference[oaicite:1]{index=1} |

| Made‑in‑China (general nickel‑titanium) | Nitinol | 1000 m MOQ | 0.75–8 USD/kg :contentReference[oaicite:2]{index=2} |

| Alibaba (mesh flat wire) | Flat/superelastic | — | 0.55–9.70 USD/kg :contentReference[oaicite:3]{index=3} |

Price Variation by Diameter & Grade

Smaller-diameter medical-grade wires (0.1–0.2 mm) are typically priced at 70–100 USD/kg due to strict production and quality control. Thicker industrial or mesh-grade wire can be as low as 0.5–10 USD/kg. Higher performance grades or ultra‑fine tolerances raise prices significantly.

Historical Price Context & Trends

Nitinol pricing is tied to raw nickel and titanium market prices, which fluctuate with LME indexes and demand. As of today, Nitinol industrial-grade pricing centers around 75–100 USD/kg in small batches, while generic industrial wire can drop below 10 USD/kg for large orders :contentReference[oaicite:4]{index=4}.

Factors Influencing Nitinol Wire Prices

| Factor | Pricing Impact |

|---|---|

| Grade & Composition | Medical-grade (ASTM F2063) costs more than generic grades. |

| Diameter & Tolerance | Fine wire (<0.5 mm) requires precision drawing and inspection. |

| MOQ & Volume | Bulk orders dramatically reduce unit cost. |

| Supplier Location & Certification | US/EU suppliers cost more than Chinese equivalents; medical certification adds premium. |

| Processing Steps | Heat treatment, annealing, polishing raise costs. |

Regional Supplier Pricing Comparison

| Region | Typical Price Range (USD/kg) | Notes |

|---|---|---|

| China (industrial) | 0.7–10 | Mesh, flat, generic; volume discounts :contentReference[oaicite:5]{index=5} |

| China (medical grade) | 75–100 | Shape‑memory superelastic wire :contentReference[oaicite:6]{index=6} |

| Global portals | 75–85 | MOQ ≥5 kg, basic industrial grade :contentReference[oaicite:7]{index=7} |

Buying Tips for Best Value

Define specifications: Determine if medical-grade certification is required (ASTM F2063). Otherwise, generic grades suffice.

Order volume smartly: Larger orders reduce price per kg. Small sample orders will be significantly pricier.

Compare suppliers: Chinese factories often offer best prices, but check quality and certification.

Include processing needs: Additional steps like annealing, packaging, or spooling add to the cost—clarify these upfront.

Track raw material indexes: Nickel & titanium fluctuations in LME affect wire prices—time your purchases accordingly :contentReference[oaicite:8]{index=8}.

Frequently Asked Questions

What is the price range for medical‑grade Nitinol wire?

Medical‑grade Nitinol wire (e.g. guide wires at 0.1 mm) typically sells for USD 70–100/kg in small batches due to strict quality and processing standards :contentReference[oaicite:9]{index=9}.

Why does industrial Nitinol cost under USD 10/kg, but medical wire is much higher?

Industrial grades have looser tolerances and minimal processing, so generic mesh or strip wire can cost as little as USD 0.5–10/kg. Medical-grade wire requires precise drawing, certification (ASTM F2063), annealing, polishing, and traceability—driving prices to USD 70–100/kg :contentReference[oaicite:10]{index=10}.

How can I get the best price on Nitinol wire?

To optimize cost, order larger volumes (≥50 kg), choose trusted Chinese manufacturers with QC records, only pay for necessary certifications, and time purchases to coincide with lower LME nickel/titanium prices :contentReference[oaicite:11]{index=11}.